The rising cost of domestic insurance premiums

Your house insurance costs are made up of premium for perils such as fire, storm damage, burglary etc. There is also premium charged for natural disaster such as earthquake, volcanic eruption etc. The EQC levy is $480 which goes towards the limited cover EQC provides, and the fire service levy is $106 which goes towards paying for our fire department. Then GST is charged on the total.

Due to the significant number of claims this past couple of years, especially extreme weather events including the Auckland floods and Cyclone Gabrielle, Insurers have had to put their premiums up. Reinsurers based in the USA and Europe provide funds to our insurance companies to help them meet the sudden and significant costs of these events because the premium collected in New Zealand is not enough to pay for these losses. Reinsurers now view New Zealand as a much higher risk than they did previously and the costs being charged to NZ based insurers has gone up by over 60%.

Alongside this, inflation and building costs have gone up too and so when a renewal offer comes through for house insurance, not only has the sum insured gone up, but so have the premiums. Insurers are trying to limit the increases passed on to you the customer but they have an obligation to ensure they can continue to meet the costs of claims being made.

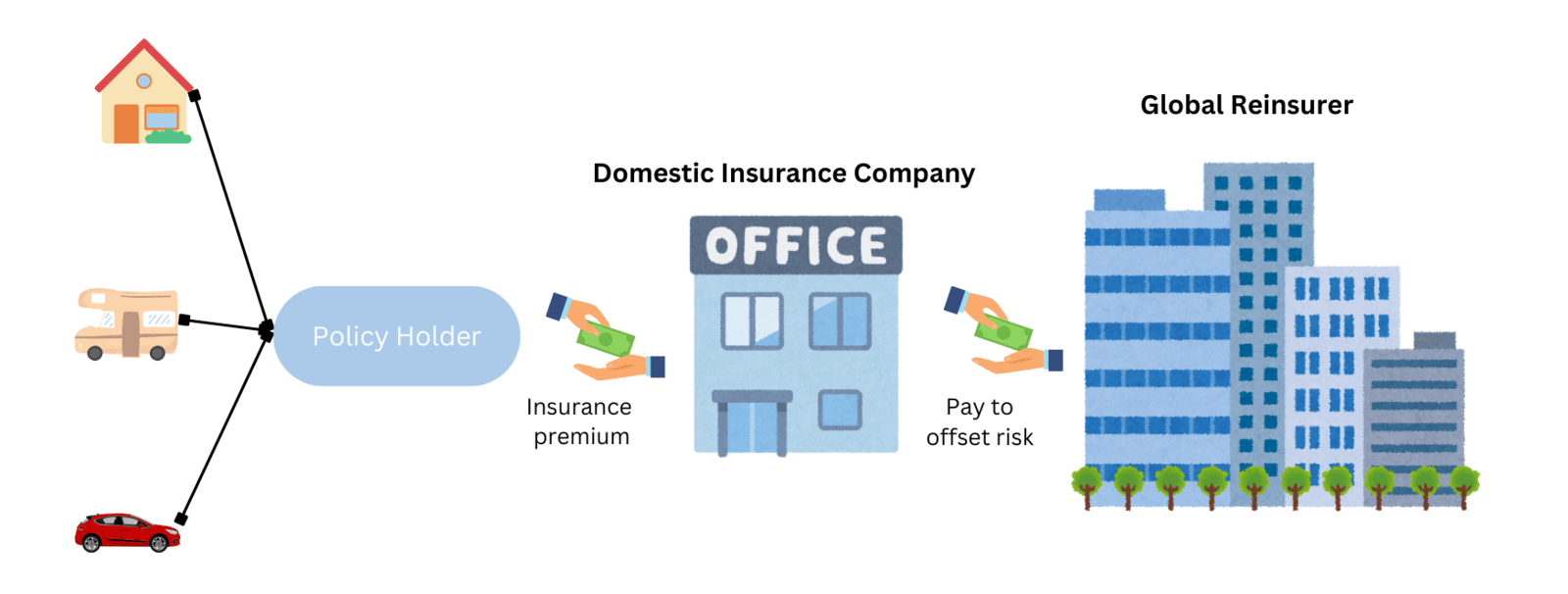

How does reinsurance work?

Reinsurance companies, also known as reinsurers, are companies that provide insurance to insurance companies.

Reinsurers play a major role for insurance companies as they allow the latter to help transfer risk, reduce capital requirements, and lower claimant payouts.

There is a clear trend of global reinsurers moving towards greater use of risk-based pricing for residential dwelling insurance, meaning that the value of insurance premiums is becoming more tailored to the specific risks a property faces (for example, seismic or flood) as opposed to reflecting broad averages of the risks facing properties over wide areas.

The Reserve Bank of New Zealand has published an excellent report on the trends and reasons why consumers are feeling the pain of rising premiums.

At HTL we strongly believe that insurance is a vital component in your financial wellbeing, and our brokers/advisers are working hard for you to keep costs down where possible, while still providing high tier service and the best possible cover.