Mid-year is a great time to take stock of your financial plan – especially in a year like this.

Markets have been unpredictable lately. Rising interest rates, inflation pressures, and global uncertainty are making many investors feel uneasy.

But here’s the truth: market volatility is normal – and reacting emotionally can often do more harm than good.

Why a long-term, diversified strategy still wins

Trying to "time the market" rarely works. In fact, some of the best gains often come after periods of uncertainty. The key is sticking to a strategy that’s designed for your goals, your risk comfort, and your timeline.

That’s where diversification comes in. A well-diversified portfolio spreads your risk across different asset types, so you’re not overly exposed to one downturn. Over time, this creates a much smoother ride toward your long-term objectives.

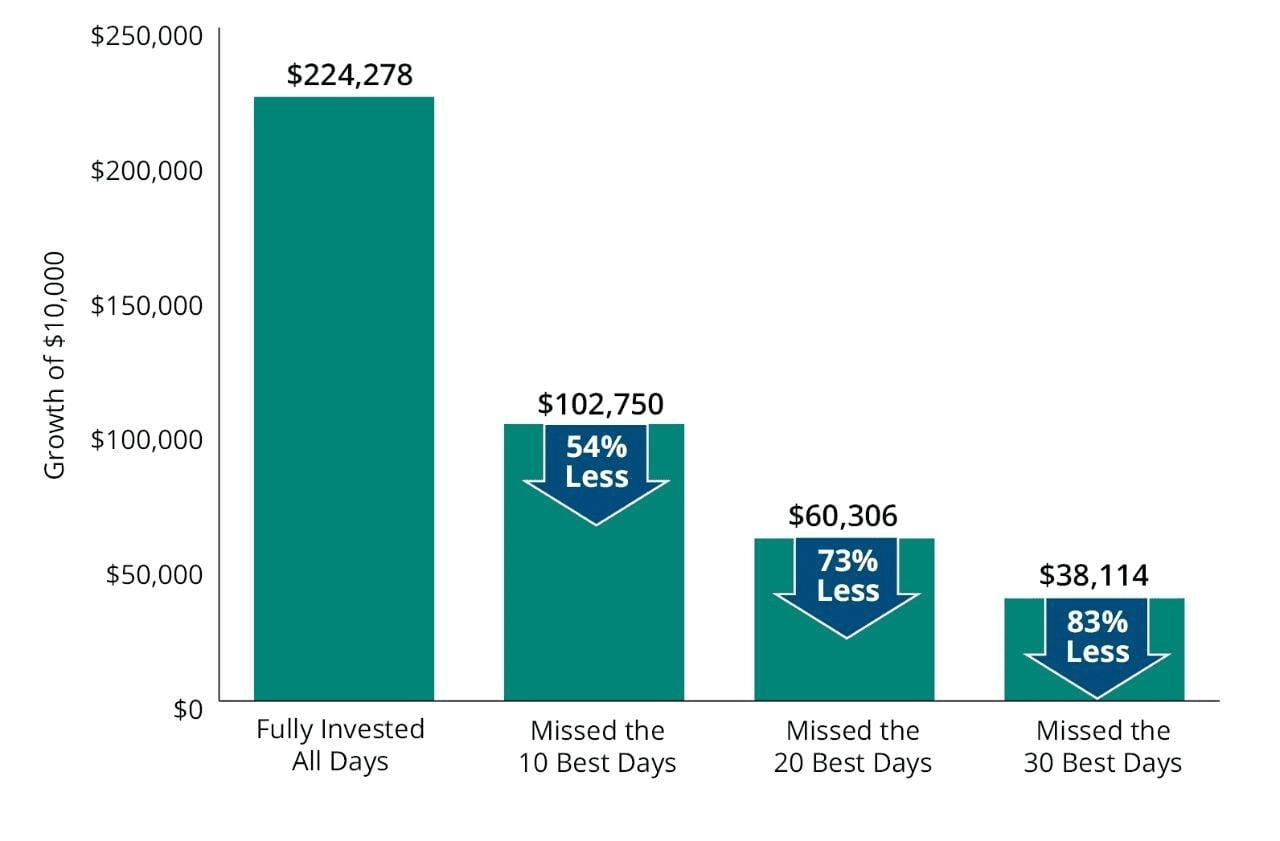

Avoiding the market’s downs may mean missing out on the ups as well. Consider this:

78% of the stock market’s best days have occurred during a bear market or the first two months of a bull market.

If you missed the 10 best days in the market over the past 30 years, your returns would have been cut in half.

Missing the 30 best days would have reduced your returns by an astonishing 83%.

The Graphs below illustrate how critical it is to stay invested through market cycles.

Good days happen in bad markets

S&P 500 Index Best Days: 1995–2024

Missing the market’s best days has been costly

S&P 500 Index Average Annual Total Returns: 1995–2024

How a financial adviser helps you stay on track

A good adviser does more than pick investments. They help you:

- Make sense of market movements without panic

- Keep your plan aligned to life changes (new job, family, goals)

- Adjust your investment mix if your circumstances or risk profile shift

- Identify new opportunities- even during volatility

At The HTL Group, we work alongside you to make sure your plan is still working for you, not against you.

And don’t forget – The KiwiSaver $521 top-up

While reviewing your investments, it’s also a perfect time to check in on your KiwiSaver.

If you’ve contributed at least $1,043 between 1 July and 30 June, the Government will top it up with an extra $521.43.

It’s a simple win- and every dollar adds up when it’s invested for the long term.

Ready for a mid-year check-in?

Whether you want to review your KiwiSaver, check your investments, or just make sure your plan still reflects where you’re headed - we’re here to help.